-

featured

Tuition

$2,201

Scholarships available

-

featured

Tuition

$2,696

Scholarships available

-

featured

About

Every successful business needs a steady hand on its finances, and that’s where skilled bookkeepers come in. From tracking day-to-day transactions to ensuring payroll is seamless and bills are on time, bookkeepers are essential to keeping any organization running smoothly. Whether it’s a small business, a large corporation, or your own freelancing gig, bookkeeping offers a career path with flexibility, stability, and plenty of room for growth.

Bookkeepers and accounting technicians are the backbone of financial operations, responsible for tasks like:

- Keeping detailed financial records and maintaining balanced accounts

- Creating and posting journal entries, reconciling accounts, and preparing trial balances

- Managing payroll, handling utility bills, and keeping up with tax remittances

- Preparing tax returns and other essential financial reports

In a nutshell, bookkeepers record, organize, and manage the data accountants use to generate reports and guide business decisions. They make sure every dollar is tracked and accounted for, helping businesses understand their financial health and meet their obligations.

While bookkeeping isn’t a regulated profession in Canada, certification can set you apart and open more doors. The Canadian Professional Bookkeepers of Canada (CPB Canada) designation represents a national standard of excellence in bookkeeping. CPB Canada has a certification pathway that can help you start from the beginning with no experience required and make your way to full certification.

Public colleges and private organizations offer bookkeeping certificates and diplomas that provide foundational knowledge for the role. Accredited bookkeeping courses will teach you accounting, income tax and payroll, how to read financial statements and manage cash flow, and more required to maintain an accurate record of a company’s financial health and tax obligations.

With the right training, you’ll be prepared to support the financial health of any business – and gain skills that are always in demand.

Frequently Asked Questions (FAQ)

What’s the difference between a bookkeeper and an accountant?

Bookkeepers and accountants work together to keep a business’s finances in order, but they have different roles. Bookkeepers focus on recording day-to-day financial transactions, making sure everything is accurate and up-to-date. They’re the ones who ensure a business’s records stay clean and organized.

Accountants, on the other hand, take that data and dig deeper. They analyze the numbers, measure performance, and provide insights on profitability and growth to guide business decisions. Generally, accountants have more formal education, which helps them interpret financial reports and assess the overall health of a business. Many accountants start as bookkeepers to build a solid foundation in financial record-keeping before moving into more analytical roles.

What qualifications do you need to be a bookkeeper?

Many bookkeepers pursue a college diploma or certificate in bookkeeping, accounting, or finance. Programs like these provide an understanding of accounting principles, business fundamentals, and hands-on software training, all of which are important for the role.

While bookkeeping isn’t a regulated profession in Canada, certification from a recognized regulatory body can improve job prospects and earning potential. The Canadian Professional Bookkeepers of Canada (CPB Canada) designation represents a national standard of excellence in bookkeeping. CPB Canada has a certification pathway that can help you start from the beginning with no experience required and make your way to full certification.

What skills and attributes do you need to be a good bookkeeper?

A good grasp of numbers and basic math is fundamental to much of the work as a bookkeeper. You’ll also want to be proficient in invoicing, accounts payable, and data entry, and comfortable using spreadsheets and formulas to organize and calculate financial data accurately.

It’s not just math: To excel as a bookkeeper, strong organizational skills and a keen eye for detail are essential. You’ll be working with financial data that needs to be accurate and up-to-date, so staying on top of details is a must. Critical thinking also comes in handy, especially when numbers don’t add up, and you need to problem-solve to find solutions. Time management rounds out the skillset, helping you juggle tasks and meet the deadlines of each billing or financial cycle smoothly.

What are the core responsibilities of a bookkeeper?

Bookkeepers are generally tasked with entering data as well as doing bank reconciliation – especially in the context of working for small businesses.

Other core responsibilities of a bookkeeper include:

- Monthly reports

- Following up on accounts (received and payable)

- Filing taxes

- Putting together yearly reports for profits and losses as well as balance sheet reporting

- Assisting business owners with their budgets and forecasting

- Providing training for staff for bookkeeping best practices as well as bookkeeping software

- In some cases, being the contact on behalf of a business owner when it comes to engaging with tax authorities

How much do bookkeepers earn in Canada?

Hourly wages for bookkeepers vary across Canada, but the median in the country as reported by the federal job bank is $25.20 per hour or roughly $48,000 per year. More senior bookkeepers can earn 1.5 times that, with average wages around $60,080, according to Indeed.

Certification

To become a bookkeeper in Canada, you will need to complete a college program in accounting, bookkeeping or a related field, likely earning a certificate or diploma. Other paths to becoming a bookkeeper include completing two years (first level) of a recognized professional accounting program (e.g., Chartered Accounting, Certified General Accounting), or pairing courses in accounting or bookkeeping with several years of experience as a financial or accounting clerk.

While bookkeeping is not a regulated profession in Canada, there are certifications bookkeepers can obtain. Top-rated bookkeeping courses in Canada were until recently recognized by the Canadian Institute of Bookkeeping (CIB); CIB since sold its assets to Canadian Professional Bookkeepers of Canada (CPB Canada), and an updated designation (CPB) began rolling out for bookkeeping professionals in May 2022.

“Former CIB members will retain their professional certification – Certified Bookkeeper (CB) — which will be treated as equivalent to the Certified Professional Bookkeeper (CPB) certification used by CPB Canada members,” according to CPB. “Only the CPB certification will be offered from now on.”

CPB Canada is a national non-profit organization that provides the CPB designation that demonstrates to employers, clients and the public that you have the knowledge, skills and experience that reflect the best practices of the profession.

CPB Canada has a certification pathway for non-certified members. You can start as a “Candidate” with no experience, no entry test, and no letter of reference required, and work your way up to “Apprentice”, “Technician,” and finally the full CPB designation, which indicates an advanced-level understanding of the more complex and difficult aspects of bookkeeping and business practices.

As well, the Registered Professional Bookkeeper (RPB) designation can be earned by writing an exam administered by the Canadian Bookkeepers Association (CBA), also a non-profit professional organization. However, it is only valid if you are a member of the CBA.

The two-semester Bookkeeping program at Centennial College will allow learners to earn a certificate that will serve as a pathway to the Certified Bookkeeper designation from the Canadian Institute of Bookkeeping (CIB). Membership in the CIB will open the door … Continue reading

Learn the payroll compliance responsibilities that affect organizations. Apply payroll legislation to calculate individual pay, calculate and report government and third-party remittances, year-end requirements and accounting for payroll at the compliance level of the organization. Graduates will be able to … Continue reading

Tuition

$1,342

Scholarships available

Tuition

$1,342

Scholarships available

Tuition & Completion Data

Domestic

Last updated: July 3, 2025

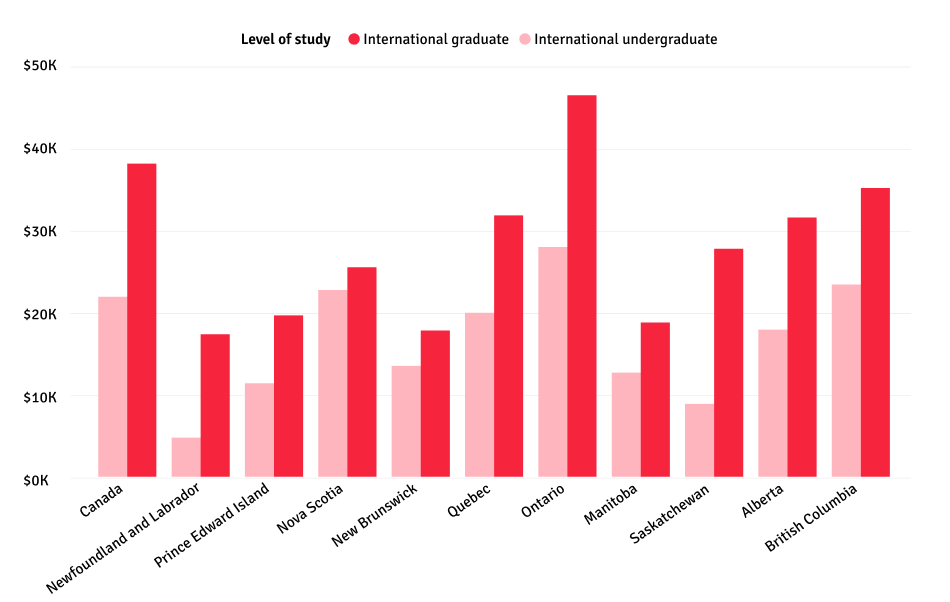

International

See below for the latest data on international student tuition across Canada, excluding housing costs and ancillary fees.

Source: Statistics Canada 2023

Careers

According to the Canadian Job Bank, opportunities for bookkeepers are expected to be generally on balance with the supply of talent although more competitive over the next five to seven years, with new job openings for accounting technicians and bookkeepers expected to total 116,700 in Canada, while 108,000 new job seekers are expected to be available to fill them.

Bookkeeper and related financial services jobs are fairly well compensated across Canada, with companies paying more in certain provinces or territories based on supply and demand. The average annual salary for a bookkeeper in Canada is about $48,874 according to Indeed, while senior bookkeepers earn closer to $60,080 with more experience and credentials.

Bookkeepers can advance in their careers to other, increasingly complex and well-compensated roles in finance, such as as business analyst, certified professional accountant, or financial controller.

Accounting Clerk – $43,149

An accounting clerk provides various types of financial support to an accounting or finance team. Their duties will vary but may include data entry and a wide range of financial transactions.

Bookkeeper – $48,874

A bookkeeper provides daily management of accounts, keeps businesses aligned with provincial and federal tax laws, and manages accounts payable and receivable. Their duties include record maintenance, clerical work, and data entry.

Payroll Administrators – $58,088

A payroll administrator or coordinator helps a payroll manager to ensure that all employees in an organization are paid on time and correctly. Their main responsibilities include processing monthly and annual bonuses, payroll for hourly and salaried employees, and generating invoices.

Business Analyst – $75,904

A business analyst is responsible for creating plans and strategies to help an organization achieve financial goals. Their duties include dealing with stakeholders to determine where the business should be headed, coming up with ideas to increase efficiencies or cost savings.

Accountant – $81,024

An accountant, or Certified Public Accountant (CPA), analyzes financial statements and other documents to ensure companies or individuals are complying with accounting standards. They analyze bank statements, tax returns, and other financial documents, create, use and maintain accounting systems, and to ensure organizations are compliant with the Canadian Tax Act and other laws applicable to a company’s financial reporting.

Financial Analyst – $102,334

A financial analyst examines financial data and predicts future financial trends. Their main responsibilities include analyzing past market trends, evaluating financial risks, and predicting upcoming financial trends in the stock market to create investment strategies.

Financial Controller – $106,806

A financial controller manages the finance and accounting departments of an organization. They may be responsible for evaluating the operations of the finance, accounting and audit departments, implementing financial systems for records management, and preparing financial statements and reports for upper management and shareholders.

Salaries

The average salary for bookkeepers in Canada is about $48,874 at the entry level, going up to $60,080 for a senior bookkeeper based on data gathered from Canada’s Job Bank, Indeed, Glassdoor, and Talent.com. Here is a closer look at salary ranges based on job type and seniority of role:

| Role | Average Salary in Canada |

|---|---|

| Accounting Clerk | $43,149 |

| Bookkeeper | $48,874 |

| Payroll Administrator | $58,088 |

| Business Analyst | $75,904 |

| Accountant | $81,024 |

| Financial Analyst | $102,334 |

| Financial Controller | $106,806 |