-

featured

featured -

featured

Tuition

$5,541

Scholarships available

About

This means that there is someone at every business, company, or organization who is responsible for making sure that everyone on the team gets their agreed-upon rates. From growing small businesses to large corporations, employers rely on a staff member (or several) to navigate their payment system and manage the salary-distribution process on a regular schedule, while following relevant employment policies and tax laws.

There are a wealth of pathways to become a payroll professional. While some enter the industry with an existing finance or accounting degree, others can enroll in colleges or universities to complete a payroll certification program, which can be completed in one to three years.

Students graduating from Canadian payroll education programs do so armed with proficiency in payroll software systems, as well as knowledge around payroll compliance and regulations. In addition, graduates will have bolstered their soft skills, such as time management, organization, and a keen attention to detail.

Payroll professionals must also develop strong interpersonal skills; they often work alongside human resources to answer employee questions around salaries, taxes, benefits and more. In smaller organizations and businesses — which can range from construction to retail and beyond — a payroll professional’s role can expand to include human resources tasks, such as hiring employees, training, and more.

According to Talent.com, entry-level salaries for payroll clerks or specialists range between $49,000-$56,000, with an average annual pay of $52,463. Alternatively, payroll directors can bring in between $105,000 to $160,000 per year, as reported by Glassdoor.

There are currently over one million small-to-medium enterprises in Canada, each employing between one to 499 employees — and that’s just within Canada’s private sector. All of the country’s businesses, companies and organizations are required to compensate employees and contractors for their labour — meaning there will always be a need for payroll professionals. In fact, the federal government’s Canadian Occupational Projection System predicts that there will be roughly 29,900 job openings for payroll administrators over the next ten years.

Frequently Asked Questions (FAQ)

What does a payroll professional do?

Payroll professionals are responsible for ensuring that employees at a company, business, or organization receive their accurate wages. Payroll professionals keep track of how many hours employees have worked, how much they earn after taxes, and that they receive their payments on time. Within smaller teams, these professionals may also take on human resources tasks such as assisting employees who have questions about their salary, benefits, and more.

How do I become a payroll professional in Canada?

While payroll professionals aren’t legally required to have a specific degree or certificate to work in payroll, having a post-secondary education in finance, human resources, accounting, or business-related fields may make a candidate more competitive in the job market. Alternatively, aspiring professionals can apply to a payroll educational program at college or university. At the end of the course, they will receive an industry certificate through the National Payroll Institute: a self-regulating body offering Canada’s only payroll designation.

What skills do I need to become a payroll professional?

Payroll professionals require deep knowledge of payroll software, an expert understanding of tax regulations, strong numeracy skills and attention to detail, and problem-solving abilities.

How much does a payroll administrator make?

The salaries of payroll professionals vary depending on their experience and specific role — for example, where payroll clerks may be focused on routine tasks like data entry, payroll managers are responsible for managing entire payroll teams, as well as ensuring tax compliance and supporting policy development.

Glassdoor estimates that payroll clerks earn between $49,000 to $56,000 per year; meanwhile, payroll administrators earn between $52,000 to $65,000, and payroll directors earn between $105,000 to $160,000. See our Salaries section below for more information about average salaries among payroll professionals.

What is the difference between a payroll clerk and a payroll administrator?

While the terms are often used interchangeably, there are some slight differences between payroll clerks and payroll administrators.

At the entry level, payroll clerk positions typically only require a high school diploma. The role includes routine data entry into the payroll system, verifying work hours on employees’ timesheets, and generating payroll reports for audits.

Payroll administrator positions and above, on the other hand, may require a diploma or degree in a related field, or a certification from the National Payroll Institute. This position’s responsibilities can include managing the entire payroll system, ensuring tax and policy compliance, training and supervising payroll clerks, and more.

Certification

Those interested in working as a payroll administrator in Canada can obtain their certifications through colleges or universities partnered with the National Payroll Institute. Here, students can pursue either the Payroll Compliance Professional certification, or the Payroll Leadership Professional certification.

To earn their Payroll Compliance Professional designation, individuals must:

- Become a member of the National Payroll Institute

- Take three core payroll courses at the institute

- Transfer a credit through a post-secondary institution for an introductory accounting course

- Complete one year of relevant work in Canada

Those looking to advance into a managerial position should consider working towards a Payroll Leadership Professional designation, which dives into payroll compliance and management skills.

To earn their Payroll Leadership Professional designation, individuals must:

- Already hold a Payroll Compliance Professional designation

- Take two core payroll courses at the institute

- Transfer credits from a post-secondary institute for managerial accounting, organizational behavioural management, and compensation and benefits management

- Complete two years of related work experiences

Learn the payroll compliance responsibilities that affect organizations. Apply payroll legislation to calculate individual pay, calculate and report government and third-party remittances, year-end requirements and accounting for payroll at the compliance level of the organization. Graduates will be able to … Continue reading

Tuition

$1,342

Scholarships available

Tuition

$1,342

Scholarships available

The Payroll Compliance Professional (PCP) certification program is offered in partnership with the National Payroll Association. This program prepares payroll practitioners to manage the compliance requirements of an organization’s annual payroll cycle, deliver clear and reliable payroll information, and contribute … Continue reading

Sep 9 - Oct 6, 2026

Sep 12 - Oct 9 2026

Jan 13 - Feb 7 2027

Jan 16 - Feb 10 2027

Tuition

$1,567

Tuition

$1,567

This two-year Ontario College diploma program provides the necessary skills and knowledge to perform effectively in entry-level bookkeeping positions as well as providing a solid knowledge of the payroll functions within organizations and the skills to perform the payroll and … Continue reading

Tuition & Completion Data

Domestic

Last updated: July 2, 2025

International

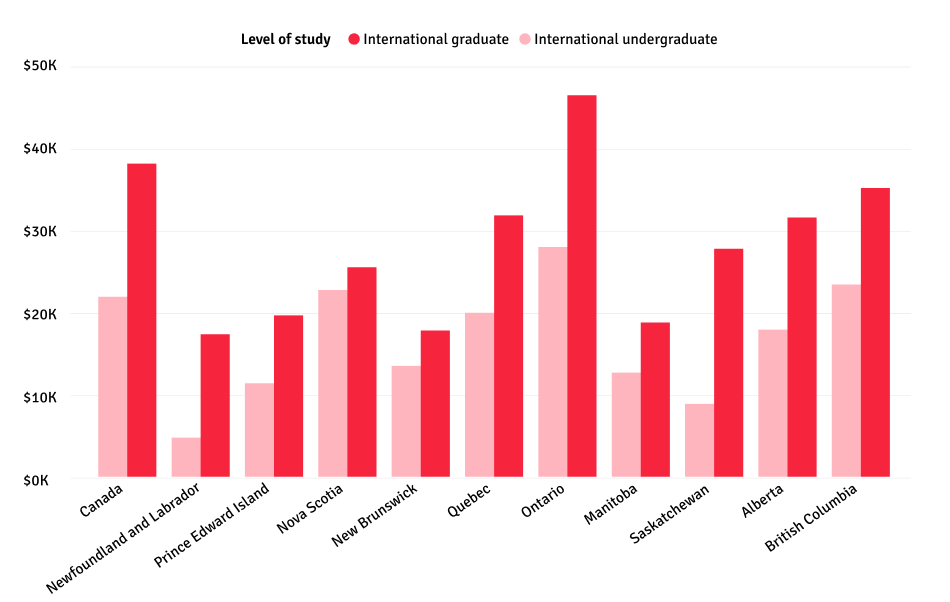

See below for the latest data on international student tuition across Canada, excluding housing costs and ancillary fees.

Source: Statistics Canada 2023

Careers

From now until 2033, payroll professionals can expect a balanced labour market, where the number of job openings are roughly the same as the number of projected applicants. As payroll workers are required for almost every company and organization to function, there will always be a demand for those with the required education and certifications, with a wide range of career options.

Payroll Clerk, Payroll Officer, or Payroll Specialist – $49,000 to $56,000

Often working for human resources agencies providing payroll services, or in-house payroll departments, payroll clerks — also called payroll officers or payroll specialists — focus on collecting, processing and verifying payroll information. They conduct data-entry for employee time records, calculate deductions, and ensure employees receive accurate pay. Additionally, this role may support managers with payroll reports and audits.

Pay and Benefits Specialist – $50,000 to $61,000

As well as handling payroll processes, pay and benefits specialists manage employee benefits, such as health insurance, retirement plans, parental leave, and bonuses. Often working closely with human resources teams to advise employees, this position ensures compliance with employment standards and organizational policies.

Payroll Administrator – $52,000 to $65,000

Payroll administrators manage payroll processes within an organization, ensuring employees are paid accurately and in a timely manner. They input payroll data into payment systems, calculate wages, handle tax deductions, and ensure compliance with tax laws and labour regulations. In smaller organizations, payroll administrators may also manage employee questions around payroll; in larger organizations, they will work closely with human resources teams to ensure smooth operations.

Payroll Manager – $69,000 to $98,000

Overseeing the payroll department, payroll managers require leadership skills and an expert understanding of payroll systems; not only do they ensure that the payroll systems run smoothly, but they also handle complex issues, develop payroll policies, and collaborate closely with human resources departments.

Payroll Director – $105,000 to $160,000

Payroll directors provide strategic oversight for payroll systems, focusing on efficiency and compliance while leveraging high levels of expertise to ensure the department aligns with a company or organization’s overall goals. As a director, this position manages teams and collaborates with the company or organization’s leadership to maximize payroll efficiencies.

Salaries

Entry-level payroll professionals can expect to make around $52,000 per year, while seasoned payroll directors can make upwards of $125,000 per year, based on data collected from Talent.com, Indeed, Glassdoor, and Canada’s Job Bank.

Here is a closer look at average salary based on job type and seniority:

- Payroll Clerk, Payroll Officer, or Payroll Specialist – $52,463

- Pay and Benefits Specialist – $58,467

- Payroll Administrator – $60,000

- Payroll Manager – $82,489

- Payroll Director – $129,521