-

featured

featuredTuition

$4,794

-

featured

featured

About

The passing of a loved one brings with it significant emotional stress, and in many cases, unexpected financial challenges — from loss of income to funeral expenses to outstanding debts.

To help tackle these financial challenges, an individual can take out a life insurance policy, protecting their family in case of their death. By paying into their policy, an individual’s beneficiaries will receive a ‘death benefit’ upon their passing: a one-time, tax-free payment to support costs. According to Canadian Life & Health Insurance Facts, in 2023, Canada’s health insurers paid out a record $128 billion in total claims — up by 13 percent from the year prior — while providing coverage for 75 percent of all Canadians.

There are many opportunities to find a career in life insurance, considered one of the most lucrative fields of insurance in Canada. Across the country, many colleges and universities offer life insurance licensing courses, including co-op placements for real work experience. In addition to becoming life insurance licensed, those who graduate from these programs do so with the relevant training, communication skills, writing practice, and commercial and legal know-how required to launch their careers. There are also educational providers such as Real Estate and Mortgage Institute of Canada (REMIC) who offer specialized training in condensed, one to two week sessions.

According to Talent.com, Glassdoor, Indeed and Canada’s Job Bank, average base salaries for insurance professionals are around $60,000 per year, but take home earnings including commission can be upwards of $125,000 per year, with more seasoned professionals earning significantly more.

Looking to the future, the Government of Canada’s Canadian Occupational Projection System foresees a moderate risk of labour shortage between 2024 and 2033 for insurance brokers and agents. This is in large part due to the numbers of retirees leaving the profession, making insurance an in-demand field, with plenty of career opportunities for first-time job-seekers.

Frequently Asked Questions (FAQ)

Do I need a licence to sell life insurance in Canada?

Yes. Each province and territory has its own insurance licenses, captured under the Life License Qualification Program (LLQP) courses and exams. Please note that Quebec has its own LLQP licence.

What is the LLQP?

The Life License Qualification Program (LLQP) is Canada’s nation-wide life insurance licensing program — including courses and an exam — and must be completed by anyone looking to work in the life insurance field. You can find out more about the LLQP under ‘Licensing’.

How do I become a life insurance agent in Canada?

Those who wish to work in life insurance typically must hold a high school diploma. Once they have met the basic requirements — which also include being over the age of 18, and having a legal Canadian residency status — prospective life insurance agents must complete the LLQP course and exam.

How much do life insurance workers make in Canada?

Earnings can vary depending on a life insurance professional’s level of experience, the pay structure of their employer, and their location. According to Talent.com, Glassdoor, Indeed and Canada’s Job Bank, average salaries for insurance professionals are around $60,000 per year, but take home earnings including commission and profit-sharing can be upwards of $125,000 per year, with more experienced agents and brokers earning well-above that.

According to Insurance Business Magazine, life insurance is one of the highest-paying insurance fields in Canada.

What is the commission for life insurance?

Life insurance professionals can earn money through a base salary, through profit-sharing with the agency they work with, or most commonly through a commission, where a percentage of the cost of the purchased policy goes towards the insurance agent.

The commission structure for life insurance agents generally includes a higher initial commission followed by lower renewal commissions in subsequent years. Agents receive a significant percentage of the policy’s first-year premium (also known as first year commission or FYC). For term life insurance, this can range from 30 percent to 70 percent, while for whole life insurance, it often falls between 90 percent and 105 percent. After the first year, agents earn smaller commissions on the policy’s annual premiums, typically ranging from 2 percent to 5 percent. These renewal commissions provide ongoing income as long as the policy remains active.

According to Insurance Business Magazine, independent insurance agents tend to have higher commission rates, whereas insurance agents working within a company typically earn less (anywhere from 5 percent to 10 percent).

Licensing

In order to work in life insurance in Canada, candidates must complete the Life License Qualification Program (LLQP). Each province has their own LLQP licensing requirements, which will need to be fulfilled in order to work within that province; in Quebec, candidates must obtain a representative’s certificate from the Autorité des marchés financiers.

The full LLQP — which includes Quebec — consists of five modules:

- Ethics and Professional Practice

- Life Insurance

- Accident and Sickness Insurance

- Segregated Funds and Annuities

- Taxation

LLQP courses, offered through approved course providers such as Real Estate and Mortgage Institute of Canada (REMIC) are a prerequisite to taking the LLQP exam. Once a candidate has completed the LLQP courses, the LLQP exam is conducted fully online. A minimum grade of 60 percent is required to pass each certification exam.

Upon completing the LLQP, newly-certified job seekers can begin searching for a life insurance company or brokerage to work with.

The Harmonized Life License Qualification Program (HLLQP) course, previously called the Life License Qualification Program (LLQP course), can be taken online (self-paced), live scheduled training, or in-person. The topics covered in the HLLQP course are based on course manuals approved … Continue reading

Jun 9 - Jun 13, 2025

Jun 21 - Jun 29 2025

Jul 7 - Jul 11 2025

Jul 19 - Jul 27 2025

Tuition

$348

Tuition

$348

This two-year Financial Services diploma program is geared towards those who want an in-depth study of the industry while also gaining important industry certifications. As students attend both theoretical and practical courses, they will also gain certifications in the Canadian … Continue reading

The Canadian Securities Institute (CSI) offers the LLQP Insurance Course as a required prerequisite for individuals preparing to take the provincial Life License Qualification Program (LLQP) exam. This program builds a strong foundation for careers in insurance, financial advising, and … Continue reading

Jul 7 - Jan 7, 2026

Aug 5 - Feb 5 2026

Sep 2 - Mar 2 2026

Oct 6 - Apr 6 2026

Nov 3 - May 3 2026

Dec 1 - Jun 1 2026

Tuition

$475

Tuition

$475

Humber’s Financial Planning Graduate Certificate program provides a clear pathway to careers in the lucrative personal financial services industry including banks, investment firms, insurance companies, financial planning firms among others. This program provides students with a broad range of personal … Continue reading

Tuition

$4,794

Tuition

$4,794

Tuition & Completion Data

Domestic

Last updated: July 3, 2025

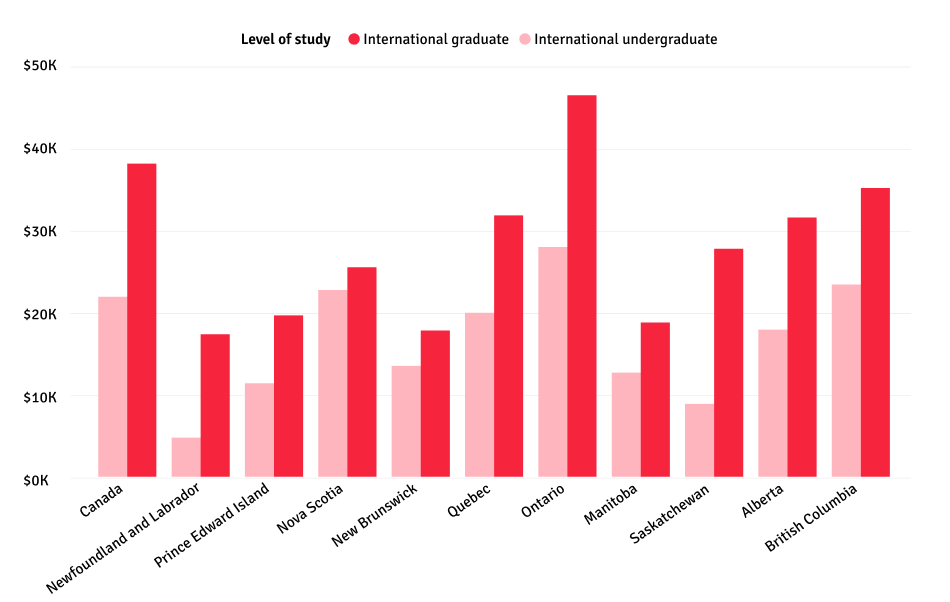

International

See below for the latest data on international student tuition across Canada, excluding housing costs and ancillary fees.

Source: Statistics Canada 2023

Careers

As with other careers in insurance — from medical to property — life insurance professionals can choose to work a wide range of jobs within the field. With the insurance industry facing a moderate risk of labour shortage over the next 10 years, it’s anticipated that there will be plenty of career opportunities for future workers.

Average salaries for life insurance workers are typically about $60,000 per year; however, these salaries do not include additional earnings which could come from commissions and profit-sharing, which make up the bulk of a life insurance agent, broker, and other professional’s earnings, and regularly deliver six-figure take home pay upwards of $125,000.

Different career paths in life insurance include:

Independent Life Insurance Broker

An independent life insurance broker serves as a middle point between companies who sell life insurance and prospective clients. Unlike a captive agent, who works for one company, a life insurance broker will sell insurance packages from any company. These professionals require high negotiation and analytical skills. This is a high-risk, high-reward role with the strong upside potential in commission-heavy compensation packages.

Captive Life Insurance Agent

A captive life insurance agent works with only one company, and is responsible for reaching out to potential clients and offering them insurance packages on behalf of the company. As well as a deep understanding of their field, these professionals display strong sales skills. This is a more stable role in the life insurance field, with less risk but also smaller commissions compared to independent brokers.

Life Insurance Case Coordinator

Life insurance case coordinators — also referred to as case managers — work with financial advisors to assist them in choosing the best life insurance policies for their clients. Case coordinators may work independently or for a firm. These professionals must be empathetic to their clients, and use clear communication skills to convey complex insurance policy packages.

Life Insurance Underwriter

Underwriters are responsible for determining the insurance risks, coverage extent, and premiums for an insurance claimant; they often work within insurance companies. These professionals must leverage analytical thinking to evaluate client requirements, as well as professionalism when handling sensitive case information.

Salaries and Commission

Life insurance professionals can earn money through a base salary, through profit-sharing with the agency they work with, or most commonly through a commission, where a percentage of the cost of the purchased policy goes towards the insurance agent.

According to the Government of Canada’s Job Bank, on average across Canada, life insurance agents make between $20.43 an hour to $49.52 an hour. That said, Ontario posts a much higher hourly rate — $55.38. The average annual base salary for a life insurance agent is $60,000 per year, but expected take-home pay is easily more than double that at $125,000 when taking into account commission.

Life Insurance Commission Structure

| Policy Type | First-Year Commission (FYC) | Renewal Commission |

|---|---|---|

| Whole Life Insurance | 40% - 70% | 2% - 5% |

| Term Life Insurance | 90% - 115% | 2% - 5% |

| Universal Life Insurance | 70% - 100% | 2% - 5% |

The commission structure for life insurance agents generally includes a higher initial commission followed by lower renewal commissions in subsequent years.

Agents receive a significant percentage of the policy’s first-year premium (also known as first-year commission or FYC). For term life insurance, this can range from 30 percent to 70 percent, while for whole life insurance, it often falls between 90 percent and 105 percent.

After the first year, agents earn smaller commissions on the policy’s annual premiums, typically ranging from 2 percent to 5 percent. These renewal commissions provide ongoing income as long as the policy remains active.

Independent brokers may earn higher commissions since they can shop multiple insurers, while captive agents (working for one insurer) are more likely to receive a mix of salary and commission, with lower commission rates. Some insurance companies also offer additional performance-based bonuses or “override commissions” for managers or agency owners.

Based on experience and annual premiums sold, assuming an agent maintains strong renewals, here’s an idea of what commission-based earnings can look like over time:

| Experience Level | Annual Premiums Sold | Estimated Annual Commission-Based Income |

|---|---|---|

| Entry-Level Agent | $50,000 - $100,000 | $25,000 - $50,000 |

| Mid-Level Agent (3-5 years) | $100,000 - $250,000 | $50,000 - $125,000 |

| Experienced Agent (5+ years) | $250,000 - $500,000 | $125,000 - $250,000 |